Inside the Self Storage Quarterly Download

This report is designed for investors who want to understand how changing conditions affect development, operations, and capital strategy in self storage.

It breaks down key industry performance trends and highlights how DXD Capital is navigating them with precision.

What Fewer Deliveries and Tighter Capital Mean for Strategic Investors

As development slows, DXD Capital sees a window of opportunity for disciplined self storage investment. Our report highlights where rates, occupancy, and supply are trending, and why developers with staying power are poised to benefit.

What Makes DXD Different

Proprietary Data-Driven Strategy

DXD Capital’s proprietary tools enable data-backed decisions, identifying emerging markets and investment opportunities.

Institutional-Quality Projects

We focus on developing institutional-grade self-storage facilities in regions with supply-demand imbalances.

Industry Expertise

Our leadership brings decades of expertise, guiding every project from conception to execution.

What You'll Learn

.png?width=2000&height=1080&name=Untitled%20design%20(13).png)

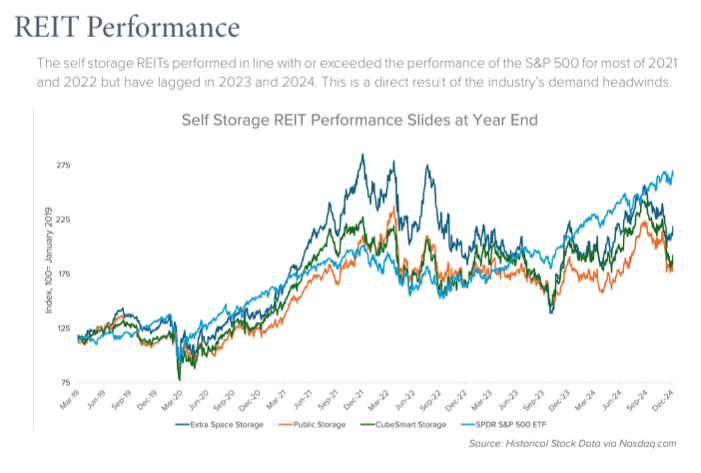

Rental Rate and Occupancy Trends: Web and in-store rates declined, while achieved rates held steady. Learn why top REITs prioritized occupancy and what it signals for 2025.

Why Development Is Slowing: Construction and lending activity are both down. See how this affects future supply and how DXD is positioning for value creation.

Strategic REIT Moves: Occupancy remains strong at over 92 percent, even in a challenging market. Understand what large operators are doing to adapt to drive revenue.

Market Timing Insights: Like Forrest Gump’s shrimp boat, developers who stay in the water through the storm may find the field less crowded and more profitable.

Sales Snapshots from Q4: View notable stabilized and lease-up sales, with price per square foot, climate control ratios, and timelines across major markets.

%20(800%20x%20800%20px)%20(3373%20x%201840%20px)%20(1).png?width=2000&height=1091&name=Untitled%20(800%20x%20800%20px)%20(800%20x%20800%20px)%20(3373%20x%201840%20px)%20(1).png)

DXD Bristol, RI: SSA 2024 Facility of the Year.

What You'll Learn

- Rental Rate and Occupancy Trends: Web and in-store rates declined by double digits, while achieved rates held steady. Learn why top REITs prioritized occupancy and what it signals for 2025.

- Why Development Is Slowing: Construction and lending activity are both down. See how this affects future supply and how DXD is positioning for value creation.

- Strategic REIT Moves: Occupancy remains strong at over 92 percent, even in a challenging market. Understand what large operators are doing to adapt.

- Market Timing Insights: Like Forrest Gump’s shrimp boat moment, developers who stay in the water through the storm may find the field less crowded and more profitable.

Educational Content: Access industry insights and educational content focused on self storage investing.

Why Invest in Self Storage

Self-storage has proven to be one of the most resilient sectors incommercial real estate, with consistent demand regardless of economic conditions. Here’s why investors are choosing self-

storage:

- Stable Cash Flow: Self-storage investments provide consistent

- rental income, even during market downturns.

- Strong Market Fundamentals: With an ever-growing demand

- for storage space, particularly in urban areas, the sector

- continues to thrive.

- Diversification: Self-storage assets offer diversification

- from traditional commercial real estate investments like

- office and retail.

- Long-Term Appreciation: Well-located self-storage facilities

- benefit from both rising property values and increasing

- rental rates.

About e-book

Nemo nibh, condimentum autem ligula ultricies, velit, sociosqu eos voluptatibus modi, porttitor natoque proin proident! Facilisis dapibus convallis molestie fugit, taciti! Itaque!

- Partnering with the right person is important for your business. Not everyone can become a Shopify expert. Shopify carefully vets their talent. Claiming to be an expert and being a real Shopify official expert are two different things.

- Ask for their work credentials. Shopify is an awesome platform. The spirit of the community is great. There are many developers who want to do Shopify work.

- It is found that “78% of consumers prefer accessing a store from the mobile website”. (Ref: Effective 2020 mobile app growth statistics to know)

- A galley of type and scrambled it to make a type specimen book. It has survived not only five centuries

Heading Text

Nemo nibh, condimentum autem ligula ultricies, velit, sociosqu eos voluptatibus modi, porttitor natoque proin proident Facilisis dapibus convallis molestie fugit.

- Desktop cinema display.

- iPad or tablet.

- Mobile device of your liking. Double check!

Fill out the form to get the e-book:

Heading Text

The headline and subheader tells us what you're offering, and the form header closes the deal. Over here you can explain why your offer is so great it's worth filling ous

Heading Text

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Odio quidem suscipit sit corporis rerum harum Expedita labore saepe ratione voluptates, animi eveniet soluta

Heading Text

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Odio quidem suscipit sit corporis rerum harum Expedita labore saepe ratione voluptates animi eveniet.

Heading Text

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Odio quidem suscipit sit corporis rerum harum Expedita labore saepe ratione voluptates animi eveniet solutaLorem ipsum dolor sit amet, consectetur adipisicing elit.

Subscribe to free resources TODAY! Be one of 2.000+ users.

Heading Text

The headline and subheader tells us what you're offering, and the form header closes the deal. Over here you can explain why your offer is so great offering.

Q. Do you design the layout, if i don't have a responsive one?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Odio quidem suscipit sit corporis rerum harum Expedita labore saepe ratione voluptates animi eveniet solutaLorem ipsum dolor sit amet, consectetur adipisicing elit.

Q. Do you design the layout, if i don't have a responsive one?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Odio quidem suscipit sit corporis rerum harum Expedita labore saepe ratione voluptates animi eveniet solutaLorem ipsum dolor sit amet, consectetur adipisicing elit.

Q. Do you design the layout, if i don't have a responsive one?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Odio quidem suscipit sit corporis rerum harum Expedita labore saepe ratione voluptates animi eveniet solutaLorem ipsum dolor sit amet, consectetur adipisicing elit.

Q. Do you design the layout, if i don't have a responsive one?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Odio quidem suscipit sit corporis rerum harum Expedita labore saepe ratione voluptates animi eveniet solutaLorem ipsum dolor sit amet, consectetur adipisicing elit.

Q. Do you design the layout, if i don't have a responsive one?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Odio quidem suscipit sit corporis rerum harum Expedita labore saepe ratione voluptates animi eveniet solutaLorem ipsum dolor sit amet, consectetur adipisicing elit.

Q. Do you design the layout, if i don't have a responsive one?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Odio quidem suscipit sit corporis rerum harum Expedita labore saepe ratione voluptates animi eveniet solutaLorem ipsum dolor sit amet, consectetur adipisicing elit.

Q. Do you design the layout, if i don't have a responsive one?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Odio quidem suscipit sit corporis rerum harum Expedita labore saepe ratione voluptates animi eveniet solutaLorem ipsum dolor sit amet, consectetur adipisicing elit.

Q. Do you design the layout, if i don't have a responsive one?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Odio quidem suscipit sit corporis rerum harum Expedita labore saepe ratione voluptates animi eveniet solutaLorem ipsum dolor sit amet, consectetur adipisicing elit.

Download Now

We help companies and marketers save time and generate more leads via drag and drop HubSpot COS conversion focussed templates.

Heading Text

The headline and subheader tells us what you're offering, and the form header closes the deal. Over here you can explain why your offer is so great it's worth filling out a form for.

Jerome Bell

CEO, Softech

Aliqua id fugiat nostrud irure ex duis ea quis id quis ad et. Sunt qui esse pariatur duis deserunt mollit dolore cillum minim tempor enim. Elit aute irure tempor cupidatat incididunt sint deserunt ut voluptate aute id deserunt nisi. Sunt qui esse pariatur duis deserunt mollit dolore.

Jerome Bell

CEO, Softech

Aliqua id fugiat nostrud irure ex duis ea quis id quis ad et. Sunt qui esse pariatur duis deserunt mollit dolore cillum minim tempor enim. Elit aute irure tempor cupidatat incididunt sint deserunt ut voluptate aute id deserunt nisi. Sunt qui esse pariatur duis deserunt mollit dolore.

Jerome Bell

CEO, Softech

Aliqua id fugiat nostrud irure ex duis ea quis id quis ad et. Sunt qui esse pariatur duis deserunt mollit dolore cillum minim tempor enim. Elit aute irure tempor cupidatat incididunt sint deserunt ut voluptate aute id deserunt nisi. Sunt qui esse pariatur duis deserunt mollit dolore.

Jerome Bell

CEO, Softech

Aliqua id fugiat nostrud irure ex duis ea quis id quis ad et. Sunt qui esse pariatur duis deserunt mollit dolore cillum minim tempor enim. Elit aute irure tempor cupidatat incididunt sint deserunt ut voluptate aute id deserunt nisi. Sunt qui esse pariatur duis deserunt mollit dolore.

Jerome Bell

CEO, Softech

Aliqua id fugiat nostrud irure ex duis ea quis id quis ad et. Sunt qui esse pariatur duis deserunt mollit dolore cillum minim tempor enim. Elit aute irure tempor cupidatat incididunt sint deserunt ut voluptate aute id deserunt nisi. Sunt qui esse pariatur duis deserunt mollit dolore.

Frequently Asked Questions

1. How Long Does It Take to See a Return on Your Investment?

- · Construction Phase (12 months): During this time, the property is being built, and no cash flow is generated. The focus is on project execution and staying within budget.

- · Lease-Up Phase (24–36 months): Once construction is complete, the facility begins leasing units to tenants. Occupancy typically grows gradually, reaching stabilization in 2–3 years.

- · Refinancing (Year 4): At stabilization, the property is refinanced to return initial capital or fund distributions to investors.

- · Distributions (Years 4–7): As the property generates steady cash flow, investors begin receiving regular distributions. This phase also sets the stage for potential exit strategies.

2. What Can I Expect for Returns?

Self-storage development offers high potential returns but comes with inherent risks. We underwrite projects to achieve:

- · At least a 2x equity multiple: the multiple of the amount of money you invested over the lifecycle of the project.

- · 20% net Internal Rate of Return (IRR): A measure of annualized profitability, accounting for the time value of money.

- · Note: Ground-up development projects carry higher risks but also higher rewards compared to stabilized assets. Market conditions, operational efficiency, and execution quality are key factors influencing outcomes.

3. Who Can Invest?

Investors typically fall into one of these categories:

- · High-Net-Worth, Accredited Investors: Includes doctors, lawyers, business owners, and individuals with:

- · A net worth of at least $2.1M (excluding primary residence).

- · Annual income exceeding $200,000 individually or $300,000 jointly for the last two years.

- · Family Offices ($150–$200M AUM): Investment firms managing wealth for affluent families, often seeking diversification.

- · Multi-Family Offices: Similar to family offices but serving multiple families.

- · Registered Investment Advisors (RIA): Professionals managing investments for clients and seeking opportunities in alternative assets.

- · Institutional Leads ($50–$100M+): Includes pension funds, endowments, and large investment firms.

4. What Are the Benefits?

Self-storage investments provide significant tax advantages, including:

- · 1031 Exchange Opportunities: Defers capital gains taxes when reinvesting proceeds into another qualifying property.

- · Opportunity Zones: For facilities located in designated areas, investors may benefit from reduced or deferred taxes on gains.

- · Accelerated Depreciation: Investors can offset rental income through accelerated depreciation, reducing taxable income significantly.

- · Operational Deductions: Repairs, maintenance, and other operational expenses are deductible, further lowering tax burdens.

- · Capital Gains and Wealth Creation: Self-storage properties often experience strong value appreciation, particularly in underserved markets or through value-add strategies. Ground-up developments provide an opportunity for long-term capital gains, which are taxed at a lower rate than ordinary income. Over time, well-positioned self-storage facilities can deliver substantial wealth accumulation through both income and appreciation.

5. How Does DXD Find Opportunities to Invest In?

We leverage proprietary technology and data analytics to identify unique opportunities. Our rigorous selection process focuses on properties with the best potential for returns and risk mitigation.

- · Data at Scale: Analyzed over 95,000 unique opportunities.

- · Execution History: Underwritten 700 projects, pursued 150, and secured 26 under contract.

6. Who is Building and Managing These Facilities?

We operate as a fully integrated real estate development and management company, with expertise in:

- · Data Analytics: Identifying and evaluating opportunities from coast to coast - utilizing proprietary technology

- · Development Management: Overseeing all aspects of development from entitlements to the construction start

- · Construction Management: Leveraging existing relationships all across the country

- · Asset Management: Optimizing property performance in lease up, revenue management and property management

7. What is the End Goal?

Our goal is to create long-term value through:

- · Portfolio Takeout by Institutional Partners: Selling a large portfolio to institutional investors, capitalizing on economies of scale.

- · Reinvestment into Future Deals: Rolling proceeds into new self-storage developments to continue generating value.

8. Why Choose DXD Capital?

We combine cutting-edge technology, robust analytics, and a fully integrated approach to real estate investment. Our team’s expertise spans:

- · Identifying Market Opportunities: Using advanced tools to pinpoint high-demand areas.

- · Executing Development Projects: Delivering projects on time and within budget.

- · Maximizing Returns: Through operational efficiency, tax benefits, and strategic partnerships.

9. How Are Investments Structured?

We employ structures designed for simplicity and transparency:

- · Limited Partner (LP) Positions: Investors hold passive stakes with limited liability.

- · Single-Purpose Entities (SPEs): Each project is isolated in its own entity, reducing cross-liability risks.

What Our Clients Have to Say

"I have discovered a class act of really smart people, who know how to deliver on the operational day-to-day execution, making deals come to life. That's why I choose to invest in DXD."

Tim Handren

Investor

"If you are looking to invest in something that is low risk, with some really good people, who deploy a great strategy – I would strongly suggest looking into investing in self storage with DXD."

Ken Barbe

Investor

"DXD Capital is working to find the sweet spot in commercial real estate development, using their team and technology to identify self storage opportunities in the best locations possible, that seem to thrive in adverse times. I am very optimistic they will continue to run a successful program."

Doug Brown

Investor

"I have nothing negative to say and I am very confident these investments will come to fruition. If you are interested in exploring self-storage investments, I highly recommend you connect with DXD."

Lori Woodcock

Investor

"I invest with DXD Capital because I know they are utilizing cutting-edge data technology to find the best self storage opportunities and the most current information."

Mandy Warr

Investor

Learn What’s Really Driving Self Storage Returns

Download the 2024 Year-End Quarterly Report to see how DXD Capital is navigating today’s market while building for tomorrow’s opportunity.